The best home improvement loans offer low interest rates, flexible repayment terms and a simple financing process. if you want to find the right fit for you, it’s important to do your research and look at each lender, along with the features they offer, to determine whether they meet your needs. 8 best home improvement loan rates of 2020. Averagehome improvementloanrates currently range from around 4 percent to 36 percent. while the rate you're quoted depends on many factors, the most important is usually your credit score; the. Solar panel loans are similar to home improvement loans that homeowners have used for decades to build a deck or add a second bathroom to their homes. when a homeowner borrows money from a lender, they agree to pay it back, plus interest, in monthly installments over the loan term.

How Do Home Improvement Loans Work Nerdwallet

Home equity loans might carry lower interest rates than a heloc, but the heloc allows you to only borrow (and pay) on what you need/use. interest rates and terms will vary by lender, but equity loan products should be pretty comparable to a 203(k). when each makes sense. obviously, home equity products require a build-up of equity to tap into. Loan payment. the most typical loan payment type is the fully amortizing payment in which each monthly rate has the same value over time. the fixed monthly payment p for a loan of l for n months and a monthly interest rate c is: = ⋅ (+) (+) −. How it compares with a home improvement loan: because of the federal guaranty, lenders generally offer lower interest rates for fha title 1 loans than on home improvement loans, and the rates are similar to those for home equity loans. you might find it easier to qualify for this type of loan than for a personal loan, but for single-family.

A home equity loan is a lump-sum loan that is secured by the equity in your home. interest rates are fixed and average around 5 percent. however, if you have good credit, your rate could be even. With a home improvement loan calculator, a potential borrower who is interested in updating their home will be able to see how much their monthly payment will be based on the interest and loan amount. these home improvement loan calculators are easy to use. simply enter the loan amount, the time frame, interest rate, and the first due date. Mbs: settlement: price: change: 30yr umbs 2. 0: february: 103-00-0-01 30yr umbs 2. 5: february: 105-04-0-01.

What Is A Home Improvement Loan Zillow

Online lender sofi offers personal loans for home improvement (among other financial products). with fixed rates starting at 5. 99% and a maximum loan amount of $100,000, sofi's financing could fit. A home improvement loan is any type of financing you use for your home renovation. personal lenders best personal loan interest rates best bank loans best small only an average of $11,851. A home equity loan is a lump sum loan that you pay back in monthly installments over 5 to 15 years. it is secured by the equity in your home. here are key features of a home equity loan: you owe interest on the whole amount: when you apply for a home equity loan, you request a specific dollar amount, then pay interest on the entire amount you. The unsecured loan would have a higher interest rate than the home equity line of credit (heloc) and the credit line can be reused if needed. for major repairs, updates or remodeling : if your equity in the home is adequate, the lender would be willing to loan you the cash needed in a number of ways.

If you have average credit, sofi is a great fit for your home typical interest rate for home improvement loan improvement loan with large borrowing amounts and flexible terms. sofi offers loan amounts up to $100,000, so it’s a great fit for more extensive projects, especially given its reasonable fixed rates. The apr shown is for a $10,000 personal loan with a 3 year term and includes a relationship discount of 0. 25%. your actual annual percentage rate (apr) may be higher than the rate shown. your apr will be based on the specific characteristics of your credit application including, but not limited to, evaluation of credit history, amount of credit requested and income verification. Home improvementhomeimprovements don’t have to break your budget. learn more about typical home improvement costs and how to use loans to help finance renovations.

Mortgage Rates And Market Data

Home Improvement Loan Calculator

9. lightstream home improvement loan. rate: 4. 99% to 13. 74% apr terms: 24 to 144 months limits: $5,000 to $100,000 fees: no fees, no prepayment penalties. lightstream home improvement loans have no fees or prepayment penalties, and there are no appraisals or home equity requirements. The lower the home improvement loan rate, the less the loan will cost you overall, so search for the most competitive rate you can qualify for. fees lenders may roll fees, closing costs and other costs, such as the origination fee, appraisal, title search and credit report fee, into the loan balance so you don't have to pay these costs at closing. The most popular way to finance a large home improvement project is with a home equity loan or line of credit or with an fha 203(k) loan. the most popular way to finance smaller projects is with.

How does a 203k loan work? fha 203k requirements 2021.

In the simplest terms, a point typical interest rate for home improvement loan is an upfront fee paid to lower your interest rate by a fixed amount (usually 0. 125%). for example, if you take out a $200,000 loan at 4. 25% interest, you might be able to pay a $2,000 fee to reduce the rate to 4. 125%. Homeimprovements and repairs can get very pricey, very fast. a minor kitchen remodeling costs an average of $20,830, vinyl window replacement is $15,282, and the addition of master bedroom could easily cost a cool quarter-million dollars.. check your home improvement loan maximum here. unless you’ve socked away some “real money,” you’ll need a home improvement loan to finance such.

Of course, larger loans translate into higher interest costs and sizeable payments. can be transferred to the next owner: if you sell a property after making improvements, you don’t necessarily have to pay off the loan. the loan is attached to the property, so it can be transferred and paid off by the next owner. Use bankrate. com's free tools, expert analysis, and award-winning content to make smarter financial decisions. explore personal finance topics including credit cards, investments, identity.

Fixed rates from 5. 99% apr to 22. 56% apr (with autopay). sofi rate ranges are current as of january 11, 2021 and are subject to change without notice. of that and move into a single family home for the first time were he and his wifecan have a family he has a problem in that his fico score is only around 500 and unfortunately, lenders are typical interest rate for home improvement loan not offering him very competitive interest rates this is pretty typical and many people get this big surprise when they apply for loans only to find that they have to pay Interest rate for homeowners is 4. 25% apr 4. 834% the annual percentage rate (apr) quoted above represents a typical $10,000 fha-insured fixed rate loan with a 20-year term. this apr is based on a 2% origination fee, $200 application fee and $100 inspection fee. The fha 203k loan is a "home construction" loan available in all 50 states. the major benefits, plus some things to watch out for.

Mortgage rates and market data.

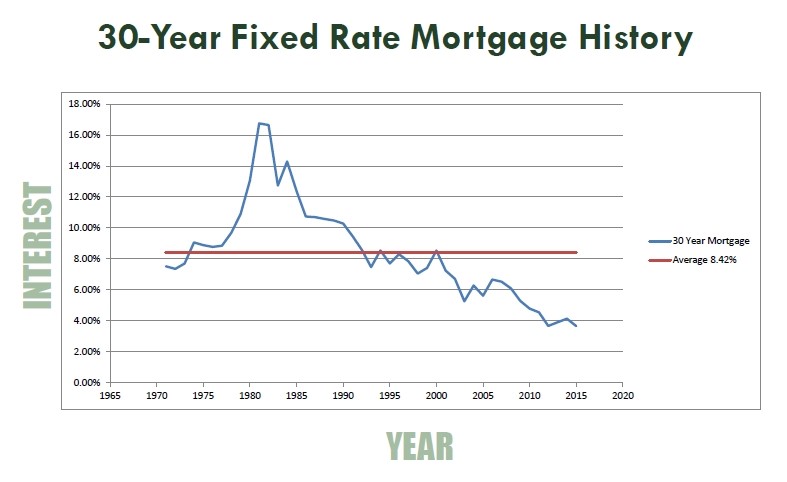

Replaces existing mortgage with a new one with a higher loan amount; provides additional funds for other purposes ; home equity line of credit : $25,000 + yes : flexibility to change between a fixed-rate advance and variable rate; interest may be tax typical interest rate for home improvement loan deductible if the home equity financing is used to improve, buy, or build a home. The average mortgage interest rate is 3. 15% for a 30-year fixed mortgage, influenced by the overall economy, your credit score, and loan type.

To help you, we reviewed over 50 lenders, evaluating each one for how much you can borrow, interest rates, fees, repayment options, and more to determine the best home improvement loans (that are unsecured) so you can achieve your home goals. these are the typical interest rate for home improvement loan best home improvement loan rates to consider. best home improvement loans of 2021.

No comments:

Post a Comment